Have you ever found a $5 bill in the street and felt like it was your lucky day? What if you found $500,000? Believe it or not, only recently an entire country’s worth of people were faced with this very question, and none of them chose to take any of it!

In fact, some of them even threw it away! All this despite being so poor they could hardly afford food. Keep reading to find out why nobody wanted any of this free cash, and how it ended up in the street in the first place!

Finding Money In The Street

Back in 2021, an armored truck was driving through San Diego to deliver cash to a federal deposit facility when it ran into a sticky situation. One of the back doors burst open, spilling thousands of bills all over the freeway! As you can imagine, commuters behind the vehicle lost their minds!

The traffic came to a complete halt, people jumped out of their cars, and utter chaos ensued as they started stuffing their jackets full of all the loose bills. Some people were even seen making it rain in the shoulder! So, these guys took the cash, and who can blame them? Something similar happened before too, in Atlanta in 2019. A Garda truck driving down Interstate 285

blew some $175,000 across the street! Drivers were pulling over left, right and center to scoop up as much cash as they could.

And before that, it happened in 2018. This time, a Brinks truck carrying $600,000

emptied out all over the I-70 freeway near Indianapolis. Nearby residents went wild, jumping over fences to grab whatever they could get their hands on.

Who wouldn’t be tempted by hundreds of thousands of dollars flying around a highway? Free money is enough to send anyone a little loco. But is that cash actually free? It fell out of the truck by accident! All this money belonged to someone. In the eyes of the law, picking up money that’s blown out the back of a truck is the same as opening the door yourself and loading it into a duffel bag!

All these people who stopped to collect the cash they “found” were stealing. It’s not rightfully theirs! So, surely that’s why nobody was taking it in the incident I mentioned in the beginning of this article? Well, not quite. Ordinarily, taking cash from the street is illegal. Unless you can prove you tried to locate the original owner, you’re guilty of ‘theft by finding’. And that extends to a measly $5 bill. If you find one on the floor, you’re legally obliged to investigate if it was abandoned or not before picking it up.

But if you do just pick it up, no one’s gonna sue you over $5, it’s not worth the time. And even if you wanted to report the $5, who wants to go to the police station, wait around for hours and fill out a bajillion forms, just to hand over five bucks? I wouldn’t trust law enforcement to track down the true owner anyway. However, the people in the clip below actually could take the money without any legal consequences. They were riding along throwing fistfuls of the stuff off their truck! But no one cared.

Personas tirando dinero en las calles de Venezuela by el trece de la buena suelte So, the people who were keeping the money weren’t allowed to but these people who could keep the money, didn’t want to? It's confusing but I’m going to explain this whole crazy situation. But to do that, first we’ve got to go back to pre-WWI Germany!

The Gold Standard

Before WWI, Germany was part of an international agreement called the Gold Standard. This set the value of the German currency, the German mark, on how much of a fixed quantity of gold it could buy.

For example, a pound of pure gold would set you back 1,265 marks, which is about $10,500 today. This system kept currencies stable by requiring a percentage of all money a country had in circulation to be held in gold. So, if the state wanted to print more money, it had to get more gold in order to do so.

Hypothetically, the Gold Standard stopped countries from spending more than they could actually afford, and kept the economy stable by doing so. But when

WWI hit, it became so expensive that a whole bunch of countries scrapped the Gold Standard entirely, allowing them to print more money and fund their war efforts without needing more gold. Fast forward to 1918, Germany lost the conflict and, because of all the money they’d printed to fund the war, the German state had built up some massive debts. On top of this, the Allied nations forced them to pay over $350 billion in today’s money to cover other countries’ damages. So, you know what Germany did to pay the debts? Simple, they printed more money of course! Here’s where it gets a little tricky. Because you can’t just print more money without big consequences.

Inflation Explained

All cash really is, is paper. Its value is intrinsically linked to the value of the goods it’s being exchanged for. If there’re loads of goods for people to buy but not much money to buy them with, then the value of those goods goes down, and the value of money itself goes up.

This is called deflation, and it leads to lower costs. On the other hand, if there’s loads of money and not much stuff, the value of things goes up, and the value of money goes down. This is called inflation, and it leads to higher costs.

Let’s say a loaf of bread costs $1, but inflation is rising by 10% every year. One year later, that same loaf of bread will cost you $1.10. And the following year, it’ll cost $1.21. But a $1 bill is still only worth $1. So, the amount that $1 can buy you is less. To ensure everybody can buy bread then, the country needs more money.

Therefore, the big money guys at the top are constantly increasing or decreasing the money supply to keep the balance. In post-War Germany’s case however, the government kept printing more and more money but couldn’t produce enough goods to keep up. That meant the balance of money to goods slid heavily towards the money, so the value of that money went down.

Hyperinflation In The Weimar Republic

When war broke out in 1914, 4.2 marks were worth one US dollar. By the end of the war, just four years later, that amount had more than doubled to 8.91 marks per dollar. But, by 1923, the government had printed so much money that one dollar was worth an astronomical 4.2 trillion marks.

By this point, Germany wasn’t just the victim of inflation, it had fallen foul of

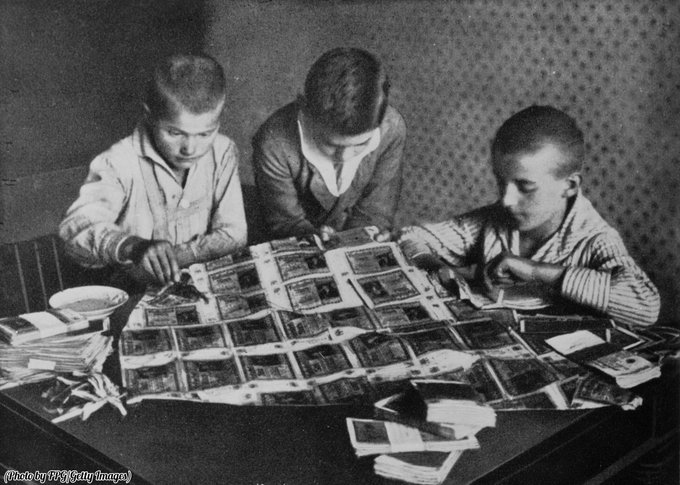

hyperinflation, which is when inflation is so high it rises over 1,000% a year. Germany was hitting over three million percent every month! Workers’ wages were so incomprehensibly high that they were paid three times a day. And this was way before credit cards. So, employers would hand over huge piles of cash every time they paid their employees.

And if they went to the store, they’d have to leave the cash-filled carts on the sidewalk before entering. Any potential thieves would’ve been more likely to steal the carts though, they were worth more! The situation got so bad that great heaps of cash were literally piled up to burn, because the notes were nothing more than a waste of space.

Indeed, people had so much money no one knew how much anything cost anymore. In 1922, a loaf of bread was three marks. By January 1923, it was 700 marks. And from there, it just kept going. In May it was 1,200, July 100,000, September 2 million, October 670 million, and in November, one loaf of bread hit 80 billion marks. You’d need so many 10-mark notes that if you stuck them together end-to-end it would reach the moon and back, and then halfway back to the moon again!

In just one year, a 10 mark note dropped from buying three loaves of bread to barely buying you a crumb. Everyone was a billionaire and it meant absolutely nothing. In fact, money became so useless that it was used as practically anything else. Banknotes were cheaper than wallpaper, made good kindling to light the stove, and were even given to kids to play with instead of toys! They’d stack them up like Legos and cut up hundreds of thousands of marks at a time to make kites. To keep up with the plummeting value, notes were issued in larger and larger denominations, steadily making the smaller ones totally irrelevant. By November 1923, there were 400 billion-trillion marks in circulation.It's safe to say, Germany was on the verge of total collapse. And yet, by some miracle, one man actually managed to fix the entire dire situation! Enter Gustav Stresemann. He became head of the German Government, or Chancellor, in August 1923, just as the crisis was about to hit its peak.

Germany was struggling hard to make its post-war payments. So, Stresemann renegotiated the payment terms into a new, more affordable schedule, which helped them start whittling away at the massive deficit. But he didn’t stop at that. He also introduced a brand-new currency, the Rentenmark. One Rentenmark was equivalent to a whopping one-trillion old marks. With this came a new money printing policy. Instead of printing more money, Stresemann restricted the money supply, keeping it limited to the real worth of the economy. These changes stopped hyperinflation in just three months.

In fact, 1923 to 1929 became known as ‘The Golden Age’ in Germany because of how much the economy boomed. And after the Golden Age? Well, we don’t need to talk about that. Let’s get back to those incidents of people throwing money on the streets and nobody touching it.

Hyperinflation In Venezuela

When there's a ton of money in the street and people aren’t taking it, it’s probably down to hyperinflation. However, this is not restricted to a European nation 100 years ago, it’s currently happening in Venezuela.

They’ve been suffering from uninterrupted inflation since 1983. By 2014, they had the highest inflation rate in the world, at 69% a year. Since then, it’s soared to unprecedented levels. The Central Bank of Venezuela predicts that between 2016 and April 2019, interest rates rose a devastating 53 million percent. And it gets even worse.Unlike the German crisis almost a century earlier, Venezuela’s economic avalanche is almost entirely down to government incompetence. They have the largest oil reserves of any country in the world, with almost 13 trillion gallons of the slippery stuff.

Seriously, if all that oil were to flow through the world’s longest river, the Nile, it would take over 39 years! To capitalize on these huge reserves, the government shifted an immense amount of their economic output into producing fossil fuels. Oil makes up an astounding 99% of Venezuelan exports and 25% of their entire earnings. Ever heard of putting all your eggs in one basket? Well, that’s a whole lot of eggs in a big oily basket. When oil prices go up, Venezuela goes ka-ching. But when oil prices go down, things are catastrophic. And that’s exactly what happened in 2014. Oil prices had doubled throughout the 2000s, from $50 for a 42-gallon barrel to over $100 for that same barrel.

At the time, large economies like China were consuming vast amounts of oil, and production levels were low due to the war in Iraq, another big producer of oil. Remember, goods go down, cost goes up. But by late 2014, oil demands in Europe, Asia and the United States began to taper off as they became more energy-efficient. Suddenly, oil was being overproduced and no one would buy it. So, the price fell hard. Like, $30 a barrel in 2016, hard. No country wants to lose 25% of their income, but that alone isn’t enough to drastically affect inflation rates. Having a corrupt leader that fires all his oil experts to install loyalists, however, definitely is. And it’s exactly what happened when Hugo Chavez became Venezuelan president back in 1999.

Just three years later, in 2002, Chavez humiliated and fired the executives of the PVDSA, the government’s oil organization, on live TV. Then, he replaced them with his political allies. But his chums knew nothing about oil, and loyalties don’t make royalties. Chavez’s gains in power and influence came at the expense of productivity. And oil production continued to fall until Chavez’s death in 2013. And things didn't improve after that. Nicolas Maduro took over as president, and from there things only got worse.

Despite the price of oil tanking, Maduro did nothing to curb government spending or fix issues in oil production. Instead, he tried to cover the financial hit by printing more money. Sound familiar? Naturally, more money meant way more problems. As Maduro printed more and more, the value of the bolivar, Venezuela’s currency, collapsed at an alarming rate.In February 2016, one dollar was worth 1,000 Venezuelan bolivars, already not a great exchange rate. Come August 2018 however and one dollar was now 5.9 million bolivars. So, just like good guy Stresemann, the government introduced a new currency, the sovereign bolivar, to ease the plummeting value of the old currency. One sovereign bolivar was worth 100,000 old bolivars, dropping the exchange rate to just 59 sovereign bolivars per dollar. It might sound like an improvement but unless actual steps are taken to reduce the economic imbalances, all you’re doing is changing the number on a piece of paper.

If money keeps getting printed at the same rate, it’s just gonna shoot up again! And, lo and behold, that’s exactly what happened. By August 2021, the sovereign bolivar had escalated all the way up to 4.2 millions per US dollar. Just like post-war Germany, cash became almost impossible to maintain. You needed seven one-million bolivar notes just to buy a loaf of bread, and as the note with the highest value, they were super hard to come by. In response, six ‘0’s were slashed off the end of the currency in October 2021 to make it more manageable. One-million bolivar became just one bolivar, which was worth a little less than 25 cents.

But all this yo-yoing does is make everyone swap their old notes for the new smaller notes, until the new notes are worth nothing, and bigger notes need to be printed. Again, and again and again. And that is why there's a lof of free cash on the streets. It’s literal trash! You could take it, but it’s the weakest currency in the world. So, what’s the point? It’s not worth your time. You might know why this happened, but it hasn’t happened in a vacuum. Millions of people have suffered because of it.

In fact, since 2015, nearly six million Venezuelans have fled their home country to escape the economic horror show. That’s one in every five people. It’s the largest displacement of Latin American people in history! And they were the lucky ones. Out of those who remain, a heart breaking 90% now live in poverty. Also, high inflation rates have wiped out almost everyone’s life savings. Imagine you spend the next ten years saving $50,000, but then at the end of those ten years the country is hit with inflation so hard that those $50,000 won’t even buy you a loaf of bread. The only thing that money would be good for is toilet paper. It’s literally cheaper for Venezuelans to use cash than toilet paper. Between 2015 and 2016, over 75% of the population lost almost 20lbs in weight. And even if you can afford food, there’s no guarantee you can get it! Terrible government policies have left shelves bare, forcing many Venezuelans to eat garbage from the street!

These are innocent people, forced to sift through trash, and probably piles of money, to sustain themselves. It’s heart-breaking. And the response of Maduro’s government really twists the knife. To supposedly ease suffering, they’ve been giving away free handouts, like food. Except they’re not really free handouts.

They’re a way of pressuring impoverished citizens to attend pro-government rallies and support Maduro in elections. What a human scab! One of the ways people have tried to shield themselves from the damage caused by Maduro and the bolivar is by not having any bolivar. By converting their money into more stable currencies, like US dollars or Colombian pesos, those that could do that have been able to dodge the insane inflation rates, a little bit at least. But this has only made the bolivar look even worse, stanking its value further. So, in response, the government fixed its exchange rate against the US dollar. Hypothetically, this should’ve stopped the bolivar from falling any more. But they also made it more difficult for people to exchange their bolivar in the first place, hoping they’d be forced to hold onto it.

However, it didn’t work. People started trading their currency on the black market instead! And because demand for US dollars was so high, these illegal markets could charge way more than the official exchange rate, driving the bolivar even further into the ground. Those not willing to pay the extortionate black market prices resorted to making things from their bolivars and selling them on. Insanely, the notes were worth more as gifts than actual money!

I’m writing in the past tense because, miraculously, the currency has made a dramatic comeback from the chaos. At the time I’m writing this, it’s

trading at 26 bolivar to the dollar! I think you’ll agree that’s a bit better than 5.9 million to the dollar. But this incredible turnaround has nothing to do with those self-centered, greedy politicians. It’s because oil prices have risen back up to around $100 a barrel, as well as Venezuela expanding into other industries at last, like gold, rum, and cocoa. Spreading their eggs into multiple baskets has done wonders for the Venezuelan economy, which grew for the first time in seven years back in 2021. For the 90% of Venezuelans living in poverty, this is incredible news. But unfortunately, it’s far from over. It’s hard to see any meaningful change happening in Venezuela without a drastic shift in how the country is run.

Piles Of Cash

And it’s not just Venezuela either, corrupt government officials around the world have been ruining their citizens’ lives for their own political gain from day one. Just look at this enormous pile of cash left in Brazil.

This isn’t down to hyperinflation, but it is a visual representation of some $4 billion recovered by the police from the country’s corrupt politicians. In this case, it’s just a promo for a movie, and the cash isn’t actually real, but that movie is based on a sad reality, Brazilian government corruption. It’s a striking visual, but it’s not an isolated case. People in major positions of power all over the world are regularly being found guilty of corruption. Like how in 2022, Swiss mining corporation Glencore were forced to

pay $1.5 billion in corruption charges, a monetary sum that would look something like the photo below if stacked in $100 bills, as one Wall Street protest art demonstration showed back in 2012.

Everywhere from Syria to North Korea, governments are impoverishing their people for their own gain, on far more serious levels. It’s not all bad, of course, if you live in Denmark, New Zealand, or Finland, count yourself lucky because you’re in one of the least corrupt countries in the world! But spare a thought for those who aren’t so lucky. Either way, Venezuelans at least are hopefully through the worst of it. So, here’s to them.